Q1 2020 coincided with Coronavirus Pandemic, 12/04/20 Official national lockdown was announced.

Retail Market reacted with +18% growth in UAH and + 15% in units Q1 2022 vs Q1 2019.

March growth was + 37% in UAH and +58% in units (vs march 2019). April is -7% in UAH and -15% in units (vs April 2019). These figures encompass all medicines, medicinal products and patient care products.

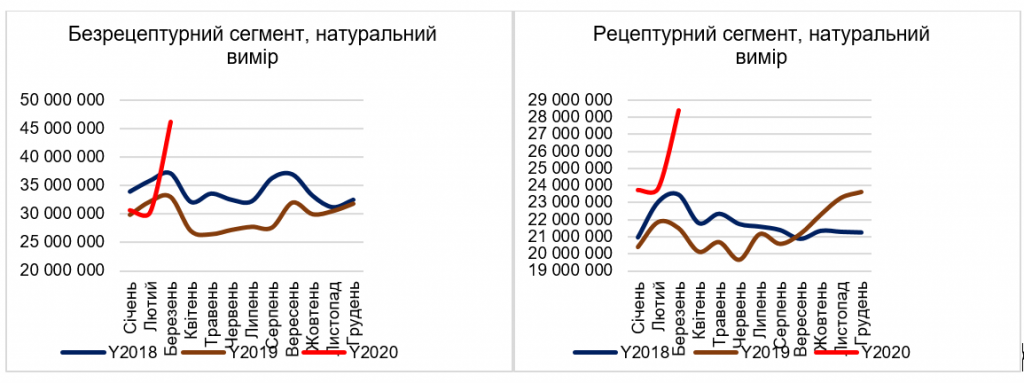

Rx and OTC markets developed in different ways. RX began to grow back in November 2019. OTC sector began to grow actively only in March 2020.

The main growth triggers for RX segment are as follows:

- Western parts of Ukraine - Lviv, Ivano-Frankivsk and Rivne regions - showed double digit growth unitwise in antibacterials (Levofloxacin, Ciprofloxacin and Metronidazol). This might be a sign of first atypical pneumonia cases in these regions close to the Western border.

- Sales of solutions for infusion grew all over Ukraine. At the end of 2019, state budget allocations stopped so the patients were forced to carry on with their treatment at their own expense.

- Sales of Affordable Medicines group of products, especially cardiovasculars, grew substantially thanks to sufficient budget.

- Pandemic and Lockdown prompted panic demand. Tenfold sales growth was observed mainly in analgesics, antipyretics, disinfectants, antibiotics (along with fluoroquinolones also grew sales of cephalosporins, glicopeptide antibiotics, e.g. Vancomycin) and antivirals (Oseltamivir, Umifenovit, Amison), vitamin C. Nasal and ophthalmology groups of products showed some good growth too.

People were stocking up on products for chronic patients (hypertension, diabetes, hormones). Experience of previous crises and out-of-stock situations pushed pharmacy sales considerably. Even essential oils were in a high demand as deodorizers for homemade disinfectants, as well as herbal teas (immunity boosters), home first aid kits, gauze, bandages for DIY masks.

Out of 58% March growth in units (vs march 2019) 41% are so called “panic demand” products and 17% product of chronic group. Population stoked up for up to 4 months.

Main pharmacy trends were:

- Growth of receipt quantities and their average value. Initially some products went out of stock sharply (masks, sanitizers, Plaquvenil, etc.) By the end of April pharmacies got overstocked as the panic is over.

- Big orders (not in SKU but in actual boxes) resulted in a stockpiling as the pharmacies could not keep up with pricing and unpacking.

- Automatic ordering systems failed due to algorithms cutting off extremums as error, thus most of the orders through March and April had to be processed manually.

- Actual stocks of pharmacies is now worth several months of sales.

Operation of the distributors was also hectic. Logistics system went into overload due to manyfold demand growth, scarcity of storage space, and overworked management. In some cases the products were sold with minimal margin to increase both turnover and opportunistic cash flow. However, by the end of March the distributor’s prices grew to cover their additional expenses.

The majority of producers exceeded their sales plans. However, there were certain problems they have encountered:

- Local producers experienced shortage of API due to export embargo imposed by producing countries several months prior to lockdown in Ukraine. As the restrictions had been gradually lifted, China renewed export in March, India partially followed in April. Dependence on API import from these countries will continue to influence the market dynamics and may cause shortages of certain products.

- In March, international producers experienced shortages of certain products due to repartition of the market.

Government purchases grew considerably in March and April. For instance, in the month before the lockdown ProZorro Government e-procurement system registered up to 5 thousand tenders against over 17 thousand in March.

Current state of affairs:

- Pharmacies are overstocked, with their operational money tied up in goods. Stock capacity of antipyretics, antibiotics, antivirals, masks, disinfectants will last for several months and will probably cover the next flu and cold season (or the autumnal wave of COVID-19.) At the same time the tied-up monetary resources won’t allow them to replenish stock of products in regular demand.

- Customer flow dwindled by mid-April due to lockdown restrictions and discontinuation of public transport operation.

- POS staff members have been experiencing difficulties getting to their work places and back. Some pharmacy chains compensated their staff for hiring taxicabs.

- Large part of marketing activity revenue of pharmacy chains, which constituted a significant part of their revenues, was practically lost in Q1. This, along with tied-up money, led to inventory shortages.

- Large pharmacy chains are most prone to losses. They have lost the marketing component of revenues and amassed large stock that crammed their available storage space. With incapacitated automatic ordering system they failed to ensure adequate manual ordering for their numerous outlets.

- After the previous crises owners of large chains have established profitable and sustainable businesses and switched to full or partial advance payments to the distributors in pursuit of more favorable pricing conditions. This factor led to amassed stock that could not be returned to the distributor.

- Small pharmacy chains face looming bankruptcy in times of crises. They normally thrive on revolving credits from the distributors. Decreased turnover in April makes it impossible for many of them to meet the timely payment of rent, staff wages, and payment for the goods no longer in demand.

- Mid-sized chains appeared in a relatively favourable position, having eliminated unprofitable POS, and having introduced category management and regular analytics both in pharmacies and chainwide.

Pandemic-related lockdowns deepened the economy crisis both in Ukraine and worldwide. The International Monetary Fund (IMF) expects a serious drop in Ukraine's economic growth due to the coronavirus - down to -7.7% in 2020, according to the IMF's World Economic Outlook for April 2020 https://www.imf.org/en/Publications/WEO/Issues/2020/04/14/weo-april-2020.

Decline of the population’s income is exacerbated by the shutdown of small and medium businesses. The unemployment soared as a result. Unemployment figures, excluding the migrant workers returning to the country, tally up to 431,9 thousand persons, according to Interfax news agency. https://interfax.com.ua/news/economic/658162.html

Should the state financing remain at the previous year level, it will partially cover the demand for medicinal products for the hospitals and the Affordable Medicines programme. As regards the outpatient care, it is highly probable that the customers will cut on OTC purchases.

Experience gained in the previous crises of 1998, 2008, 2010 seems to be not relevant for short-term (3-4 months) prognoses but may be relied upon to plan for assortment and volumes for autumn 2020 and for the year 2021.

The probability of 2020 retail market decline by 5% in UAH and 15% in units is very high. The steepest decline is expected in May and well into summer. The market will recover by October-November 2020, should there be no second wave of coronavirus.

Irina Gorlova, CEO of SMD company

Contact information: