Why Gummies Are Popular and On-Trend

Since starting out as a much-loved gelatinous confectionery, gummies were first employed as a popular oral delivery vehicle for vitamin and mineral supplements for children in the mid-1990s, and primarily in the North American market.

Not surprisingly, those that enjoyed gummy vitamins as children have retained an affection for them into adulthood. The gummy vitamin market has been dynamic in evolving and innovating to cater to broad consumer preferences to attract new gummy converts, particularly those who have “pill fatigue.”

Vitamin gummies can now be manufactured and formulated to be plant-based (e.g., pectin or carrageenan based), low sugar or sugar free, and free from artificial flavors or colorings. Though common formulation challenges may include addition of high active load, sugar reduction, stability, and more.

Research and Markets valued the global gummy vitamin market at $6.44 billion for 2022, predicting 8.9% growth to $9.08 billion by 2026.

What Are the Challenges of Gummy Manufacturing?

Given the popularity of gummies in the nutraceutical market and issues with patient adherence, particularly with poor tasting pediatric oral medicaments and patients suffering chronic conditions, pharmaceutical companies are also considering the viability of the gummy as a vehicle for active pharmaceutical ingredients (APIs), in order to improve patient experience with certain oral medications.

Historically, however, there have been a number of challenges that have stalled the use of gummies as a vehicle for APIs. The reliance on heat in traditional gummy manufacture can have unwanted effects on medicament stability compared with normal pharmaceutical tableting processes, which is one hurdle to overcome.

Moreover, in contrast to tablets and capsules, gummies are not typically protected by films (e.g., in a blister pack), which can contribute to stability and degradation issues. Indeed, in the nutraceutical sector, it is common to use excess amounts of a vitamins and other dietary ingredients during gummy manufacture to counteract a level of degradation of the active during processing or storage.

This is not an acceptable scenario in the pharmaceutical industry where dosage level is of paramount importance and APIs can be extremely expensive.

Another problem can relate to the solubility and/or chemical stability of APIs in the gummy formulation itself. The particular API may, for instance, undergo unwanted reactions with components of the gummy formulation or lack sufficient solubility within it, which can complicate the accurate dosing of API in individual gummies.

Per good manufacturing practices (GMPs), it is critical to prevent microbial contamination during gummy processing.

Recent innovations in gummy formulation and manufacture have improved to the point that medicinal gummies might be a realistic offering in the future.

Process Innovations Create New Growth Opportunities

Traditional gummy manufacture has relied on the use of a “starch mogul” system which relies on a starch-based mold within which the gummy formulation is deposited, set, and removed, before the starch is recycled.

However, the use of starch/recycled starch molds can pose difficulties in maintaining sufficient hygiene levels and ensuring that there is no cross-contamination, particularly for pharmaceutical-grade products.

However, the use of starch/recycled starch molds can pose difficulties in maintaining sufficient hygiene levels and ensuring that there is no cross-contamination, particularly for pharmaceutical-grade products.

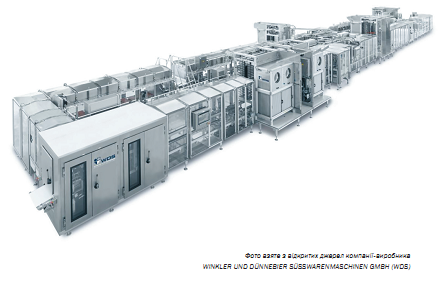

Manufacturers have looked to provide alternative starch-free systems to overcome those problems. For example, Baker Perkins has developed the ServoForm line of starch-free jelly and gummy depositing machinery.

More recently, Baker Perkins has also collaborated with functional ingredient manufacturer, Rousselot, which has developed a patent-protected SiMoGel method enabling a gelatin gummy mixture to be deposited into silicone or metal-based molds, or directly into blister packs, as a hygienic alternative to starch-moguls. This not only elevates hygiene levels up to pharmaceutical standards it also reduces gelatin setting times from approximately 24 hours to less than 15 minutes, thereby increasing output potential significantly.

Center-Filled Gummies

Another development that may offer the greatest impact in bringing medicinal gummies to market is the center-filled gummy, in which a gummy outer shell is provided with a liquid core. Different gelatin formulations have been developed by manufacturers that are increasingly compatible with low-temperature processing.

However, the center-filled gummy allows separation of gummy formulation ingredients in the shell, which may be processed at high temperature, from those of a liquid core formulation which contain functional ingredients (such as APIs).

The separation can also prevent unwanted interactions between functional ingredients and those of the gummy formulation, while the gummy shell can act as a moisture and oxidation barrier to the functional core, thereby having a protective effect, helping to ensure adequate stability and shelf life of functional ingredients.

The liquid core can also facilitate more accurate dosing of an active functional ingredient in an individual gummy, so that there can be certainty in dose levels to satisfy pharmaceutical requirements. Center-filled gummies are now on offer from Rousselot (gummy caps) and Sirio (ChewyVita), which have been put to use in the nutraceutical sector.

First Investigational New Drug (IND) Application

An illustration that the tide may be turning toward medicinal gummies is also in the award of a first Investigational New Drug Application (IND) from the FDA with regard to Seattle Gummy Company’s allergy gummy medication. The company claims to have a large pipeline of gummy drugs in development, with patent applications having been filed to gummy compositions with APIs, including antihistamines and analgesics (WO 2022/119959 A1, US2021386732 A1).

An illustration that the tide may be turning toward medicinal gummies is also in the award of a first Investigational New Drug Application (IND) from the FDA with regard to Seattle Gummy Company’s allergy gummy medication. The company claims to have a large pipeline of gummy drugs in development, with patent applications having been filed to gummy compositions with APIs, including antihistamines and analgesics (WO 2022/119959 A1, US2021386732 A1).

High Value Acquisitions

Another indicator of the potential for medicinal gummies might also be illustrated by Catalent’s recent acquisition of Bettera Holdings, a gummy and lozenge manufacturer, for $1 billion. Catalent, a leading global provider of development sciences and manufacturing platforms for medicines and consumer health products, stated the acquisition is “a key strategic move for Catalent’s Consumer Health business, where our leadership in manufacturing technologies and formulation can offer customers more product development opportunities and add manufacturing capacity in this dynamic and fast-growing segment.”

Catalent is well known for providing oral formulation expertise to the pharmaceutical industry and its softgel technology already bridges the gap between the pharmaceutical and nutraceutical sectors by providing oral delivery solutions for supplements as well as APIs. Bringing gummy expertise into the fold seems to be a strong sign that the door to medicinal gummies may soon be opening wider as Catalent seeks to capitalize on bringing gummies to new product categories.

Given the continuing growth of gummies and the shift in consumer preferences, expect more activity and innovation in both the nutraceutical and pharmaceutical markets.

Summary

The gummy sector is a particularly fast-growing branch of the nutraceutical sector and there appear to be signs that historic barriers to the use of gummies as an oral delivery vehicle for APIs are being removed by continued manufacturing innovations.

It seems only a matter of time before medicinal gummies are available, particularly to pediatric or geriatric patients, or those with chronic conditions, where traditional pill form medicaments may be poorly tolerated or there may be issues with non-adherence to treatment regimes.