KEY FACTS ABOUT THE ECONOMIC DEVELOPMENT OF UKRAINE1

Ukraine is one of the largest countries in Europe. Our country ranks 56th in the world in terms of absolute GDP, and 119th in terms of GDP per capita. According to the World Bank2, GDP per capita in 2021 was USD 4,836, the average annual growth over the past five years (2017 – 2021) was 16.5%

Ukraine is one of the largest countries in Europe. Our country ranks 56th in the world in terms of absolute GDP, and 119th in terms of GDP per capita. According to the World Bank2, GDP per capita in 2021 was USD 4,836, the average annual growth over the past five years (2017 – 2021) was 16.5%

per year.

Ukraine has a powerful pharmaceutical industry, where more than 150 manufacturers work. The country is a member of the Pharmaceutical Inspection Cooperation Scheme (PIC/S)3 , which opens wide opportunities for simplifying the registration and import of medicines to the PIC/S countries.

The capacities of domestic pharmaceutical manufacturers can be more actively used for import substitution of some drugs and medical products, as well as for export.

Market by product categories

The category that "grew" during the war year is patient care products (+27% in monetary (UAH) terms, MAT for March 2023 vs. MAT for March 2022).

The share of war-related categories increased the most among patient care products (surgical supplies, wound care products, artificial joints, etc.).

The indicators of personal hygiene products were better than in the general market (-5% vs. -18%, respectively, in value (UAH) terms). This is most likely due to the "spill-over" of products from destroyed/closed supermarkets and specialty shops to pharmacies in both the affected areas and those receiving the maximum number of internally displaced people (IDPs).

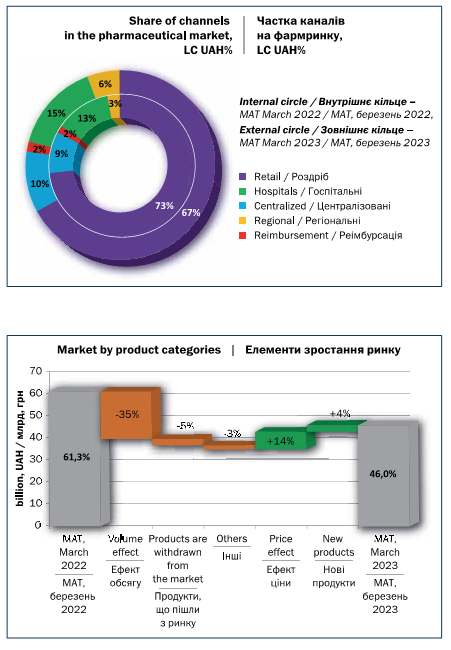

Market by sales channels

The volume of government purchases has increased significantly and is 40% of the total sales volume of the MAT market for March 2023, which is 9% more than the previous year.

The volume of government purchases has increased significantly and is 40% of the total sales volume of the MAT market for March 2023, which is 9% more than the previous year.

Centralized procurement, namely procurement by international procurement agencies (UNFPA, UNDP, Crown Agents) and procurement by the Central Procurement Agency Medical Procurement of Ukraine, significantly increased its market share – up to 16% by MAT in March 2023 compared to 11%

for the same period last year.

The influence on the market and the importance of the reimbursement the Affordable Medicines program have increased significantly. Taking fixed prices into account, the Affordable Medicines program showed greater growth in volume than in value terms, with its market share increasing from 3 to 6% in value (UAH) terms. Decentralized government procurement of hospitals increased the market share in terms of value (UAH) to 18% for MAT in March 2023 compared to 14% for the same period last year.

The increase occurred in two directions: the first is the assortment of goods related to the war, which was purchased by certain medical institutions; the second – is regarding the internally displaced population (IDP) (this assortment was directed by the flow of IDP).

The total volume of the drug market for the entire war year according to MAT in March 2023 was

UAH 46 billion or USD 1.2 billion. The share of the category of drugs decreased mainly in the retail segment (-37% in kind and -28% in value (UAH) dimension) than in public procurement (-26 and -21%, respectively).

This led to an increase in the state's overall market share to 33% for MAT in March 2023 (vs. 27% for MAT in March 2022), including the Affordable Medicines reimbursement program. It is important that despite the difficult situation due to the war, the state has even increased funding and already covers a third of the entire drug market.

The share of reimbursement due to the expansion of the Affordable Medicines program in such categories as diabetes (insulin), mental and behavioral disorders, and Parkinson's disease also increased significantly.

The biggest negative impact on the market was the effect of a decrease in natural volume; also slightly more products disappeared from the market than new ones were launched (-5% vs. +4%). Indian, Russian, and Belarusian companies, as well as small manufacturers with niche products, left the market. The price effect had a positive effect on the market (+14%), but was lower than the rate of inflation (27% per year)4

Import and local production

Ukraine has always been a traditionally powerful local manufacturer of medicines. Since January 20115, our country is a member of PIC/s. Drug manufacturers have GMP-certified production facilities and the biggest manufacturers export drugs all over the world. It is important to note that after significant fluctuations during the first months of the war, the market share of local manufacturers continued

to grow and reached 72.9% in physical terms and 40.3% in monetary terms by the end of the war year.

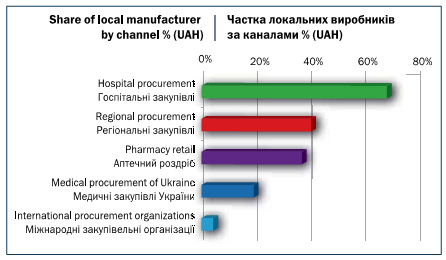

At the same time, the market share in terms of value (UAH) of local manufacturers differs significantly depending on the channel: from 70% in hospital procurement, 42% in regional procurement, 38% in the retail segment, 20% in procurement carried out by the Central Procurement Agency Medical Procurement of Ukraine, up to 2% in central tenders carried out by international procurement organizations.

The least number of local manufacturers in centralized purchases is explained by the high share of purchases of patent-protected drugs that are included in nomenclature lists and national programs.

Local manufacturers have a higher market share of over-the-counter products (29% in UAHs) compared to imports (24%) and the market average (26%). This share has been generally stable over the past 3 years.

The ranking of the countries of origin also remains quite stable: local manufacturers occupy the 1st place with a growing market share, Germany and India are consistently in the 2nd and 3rd places, despite the decision of some Indian companies to suspend their activities or even leave the Ukrainian market. Chinese manufacturers are regaining market share (mostly due to the vaccine against COVID-19).

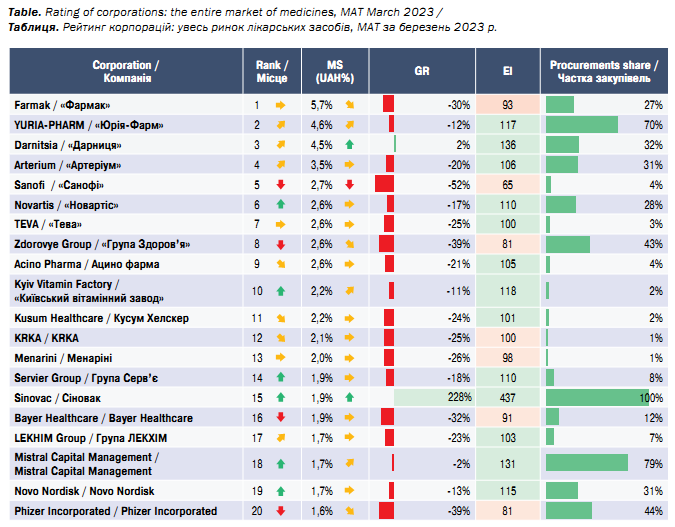

Changes in market structure and ratings

There were no significant changes in the TOP-10 of the retail market. Farmak kept the lead, and Darnitsia came close to it, pushing Sanofi to the third position. TEVA's position is stable, and Acino Pharma and Kyiv Vitamin Factory have improved their positions. Manufacturers such as Arterium, Kusum Healthcare, KRKA, and Menarini, on the contrary, somewhat lost their positions in the rating but remained in the top ten.

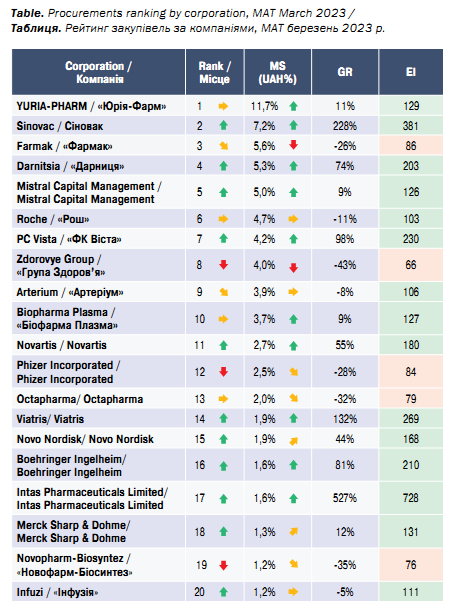

In the segment of state procurement, the primacy remained with Yuriya Pharm, followed by Sinovac (manufacturer of the vaccine against COVID-19). Farmak is the third company in this segment. Darnitsia reduced its market share, Mistral Capital Management, Roche, PK Vista and Arterium significantly improved their positions in the TOP-10. Zdorovye Group, located in Kharkiv, lost some positions but remains in the TOP-10. In the market mix, sales, and market share of injectable antibiotics, antithrombotic agents (enoxaparin) and glucocorticoids continued to decrease, typical for COVID period. The consumption of anti-varicose, anti-diarrheal drugs, and means for the treatment of the throat and nose also decreased. Of the significant decrease in certain population groups, the relevant categories also show the same dynamics. For example, the population of children has decreased

by 40% due to migration, which has led to a decrease in the volume of sales of liquid pediatric dosage forms, such as the volume of J01/DG (systemic antibacterial drugs in oral liquid conventional forms) has decreased by 56% compared to the previous year, R06 /DG (systemic antihistamines in liquid conventional forms) – by 47%, etc. Consumption of nasal (-56%) and ear preparations (-41%) also decreased. Thus, groups of products mainly consumed by children and women had a predictably lower demand due to a significant decrease in the population of these particular population groups. Sales of oncology drugs, vaccines (thanks to large donations), and immunosuppressants have increased significantly.

In addition, the structure of their sales has changed (taking into account the significant receipts of targeted humanitarian aid). All this is connected with a significant increase in the volume of public procurement. Consumption of infusion solutions, hemostatic agents, narcotic analgesics, anxiolytics, psycholeptics, non-narcotic analgesics, etc. increased. The consumption of antihypertensive drugs

(especially those affecting the renin-angiotensin system) has also increased. The increase inьconsumption of drugs with anxiolytic and sedative properties (primarily gidazepam), as well as many others, including herbal preparations, was noted.

The volume of sales of individual products exceeded that of last year. The widespread use of these products may be compensating for the relatively low consumption of antidepressants (even the inclusion of a group of antidepressants in the Affordable Medicines reimbursement program has not yet affected their consumption).

Factors that affect and will continue to affect the development of the pharmaceutical market

The main factor in market stabilization and growth will be state funding programs (basic guaranteed treatment in hospitals and further development of the Affordable Medicines reimbursement program).

In the short-term perspective, pediatric and gynecological groups of products will be displaced by those focused on the treatment of post-traumatic syndrome, with a further increase in the share of drugs for the treatment of chronic diseases and diseases in the elderly.

Local manufacturers and generic companies will continue to have an advantage in both retail and government procurement due to their wide range and affordability. Originators will have sales potential in large cities with multidisciplinary and specialized private clinics. The market is changing and will continue to change geographically. Western regions will show predominant growth according to the number of IDP, demographic distribution, and income distribution.

The development of hospitals connected with the war, their equipping with modern surgical, orthopedic, and resuscitation equipment, forced training, and the acquisition by the staff of colossal unique clinical experience will create the basis for the creation of modern multidisciplinary national clinics of world importance. The long-term perspective envisages significant growth of the pharmaceutical market with the support of a broad international coalition of countries focused on post-war reconstruction and the development of Ukraine's economic potential based on the movement towards EU and NATO membership.

Irina Gorlova,

director of the SMD company